Built for control. Powered by AI. Loved by finance teams.

One Platform. Total Control. Zero Manual Work.

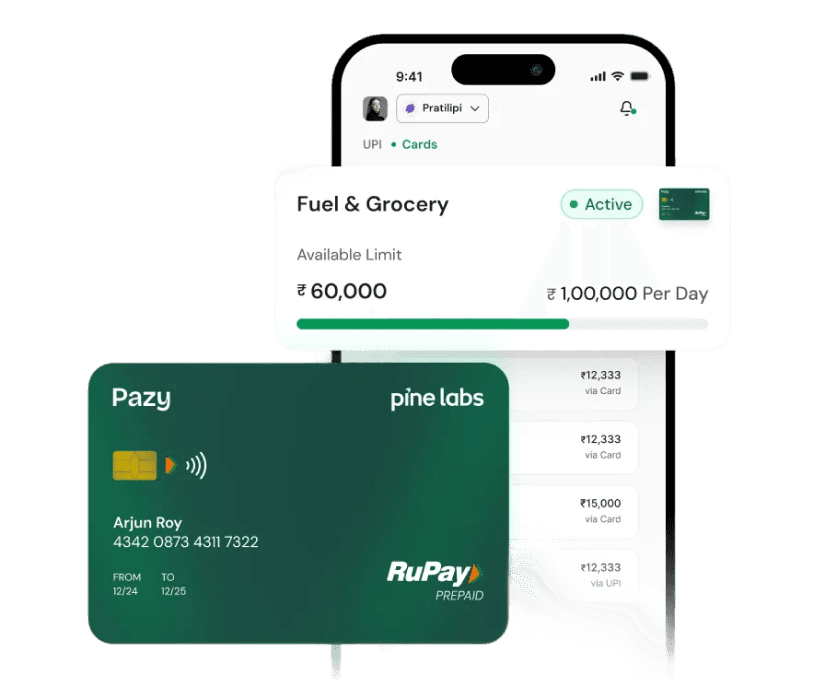

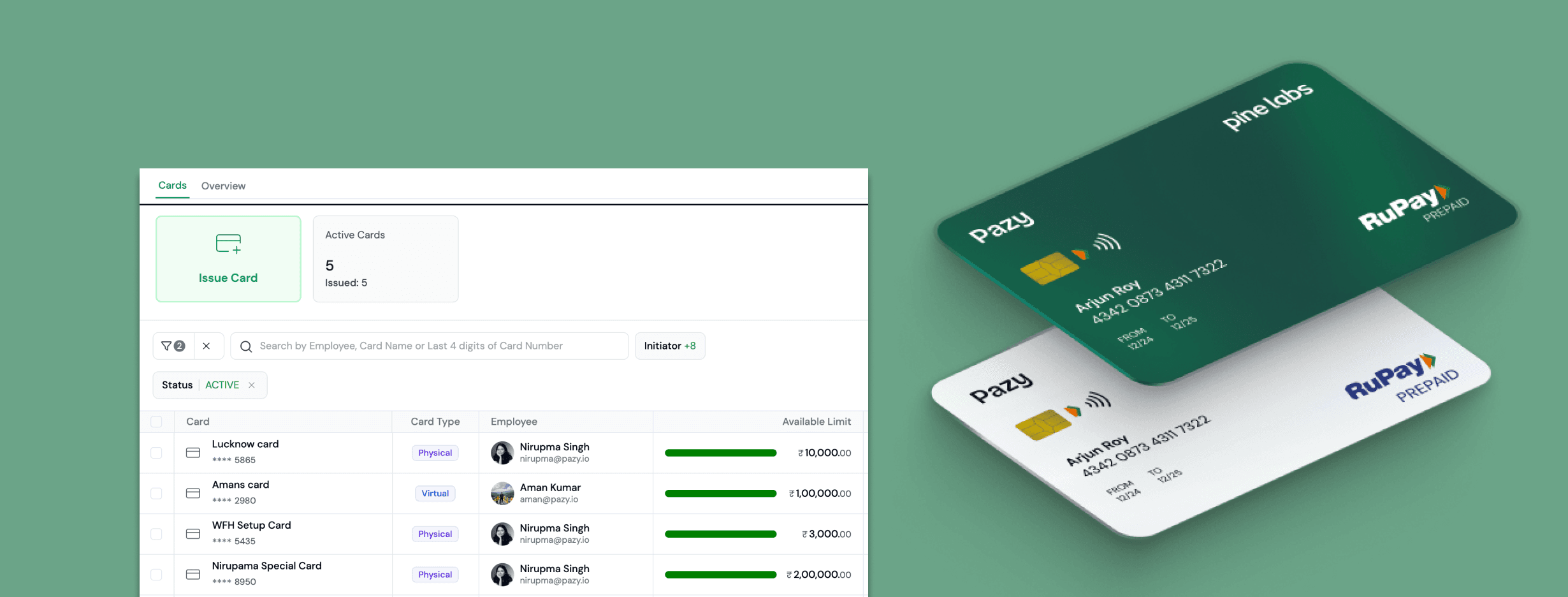

Issue cards instantly — physical or virtual, for any purpose

Create unlimited corporate cards under one company KYC. Whether it's reimbursements, travel, admin expenses, or employee benefits — issue dedicated cards for each use case and control them all from a single dashboard.

Physical & Virtual Cards

Issue physical cards for on-ground teams or virtual cards for online purchases. All cards are created instantly with no paperwork or delays.

Employee Lifecycle Control

When an employee leaves, block or disable their cards (physical or virtual) instantly. No loose ends, no unauthorized spend.

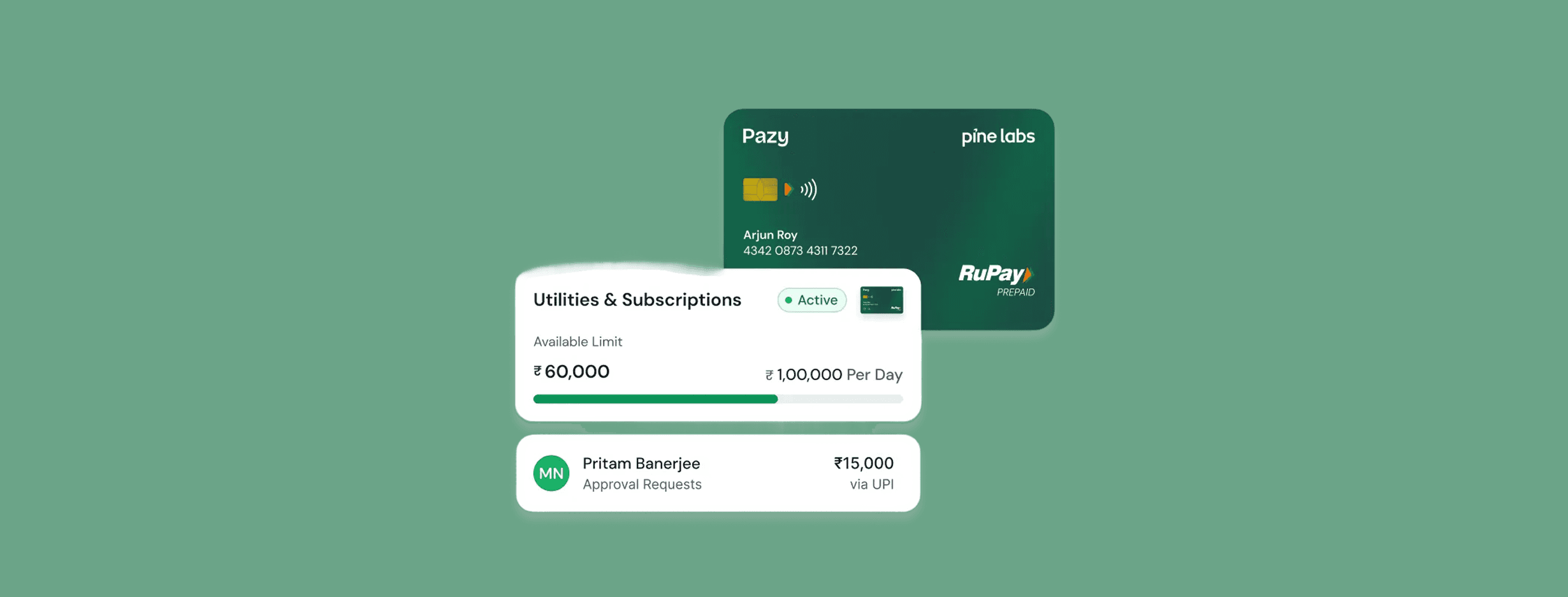

Define rules once. Enforce them automatically, every time.

Set spend limits, add your company's policies, and control usage down to the merchant level. Block or allow specific outlet types using official government-assigned MCC codes — so out-of-policy spend never happens.

Custom Spend Limits & Rules

Define spending limits per card, per day, per transaction, or per category. Add your company's expense policies and let Pazy enforce them automatically.

MCC-Level Control

Block specific merchant categories like liquor shops, entertainment venues, or personal shopping sites using official Merchant Category Codes (MCC).

100%

policy compliance with automated spend rules

One master account. Zero manual top-ups.

Stop juggling balances across dozens of cards. Maintain a single master account and let Pazy automatically route funds to cards based on their limits and rules. Pay vendors, utilities, and even BBPS portals directly.

Centralised Funds Management

Keep all your money in one master company account. Pazy intelligently routes funds to individual cards based on their spending rules — no manual intervention needed.

Pay Anywhere, Including BBPS

Use Pazy cards to make BBPS payments directly on government and utility portals. One card for everything — vendors, subscriptions, utilities, and more.

Every transaction reviewed. Every receipt collected. Automatically.

Pazy's AI agent reviews every transaction in real-time to flag policy violations or unusual activity. Employees must upload receipts after each swipe — miss one, and the card softly locks until they comply. All data syncs to your ERP in one click.

AI-Powered Oversight

Every transaction is reviewed in real-time by Pazy's AI to flag out-of-policy spending, duplicate charges, or unusual activity before it becomes a problem.

Mandatory Receipt Upload

No more chasing receipts. Employees upload them after every swipe, or the card locks automatically until they do. Compliance happens by design.

70%

less time spent reviewing lengthy documents