Case Studies & Stories

How Sprinto gained visibility over spend with Pazy.

n the demo, it became very clear that Pazy's approach is very attuned to the needs of the customer.

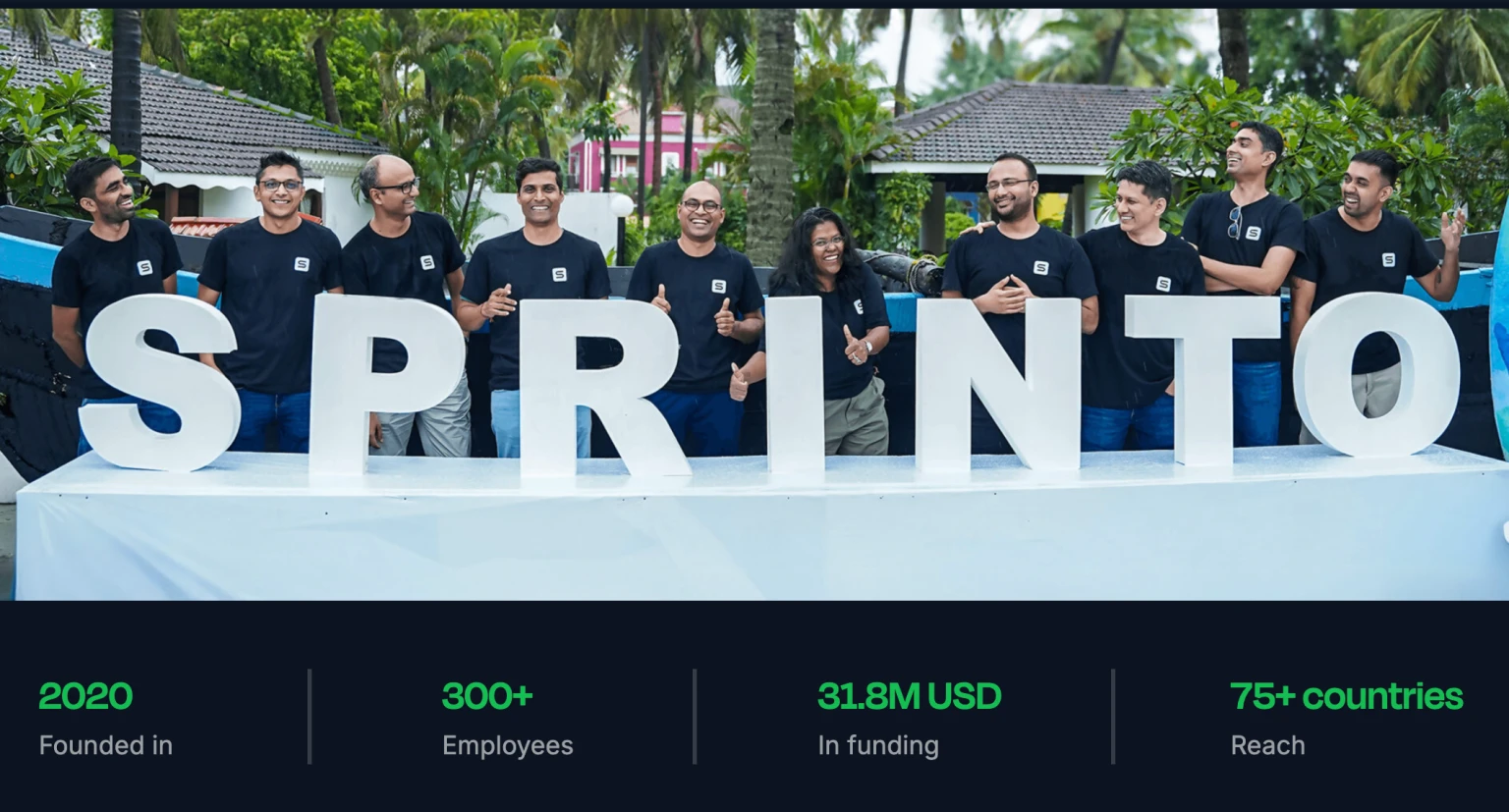

About the company

Sprinto is a Governance, Risk, and Compliance (GRC) automation platform specifically designed for SaaS companies. It helps businesses streamline compliance processes, particularly for frameworks like SOC 2, ISO 27001, GDPR, and HIPAA, by automating tasks like evidence collection, access reviews, and continuous monitoring.

The Problem

Everyone would just come and dump the invoices to us, they were not realizing that Accounts Payable is not the only task of the finance team.” Naga Subramanya, the Finance Director of Sprinto; a compliance automation platform for 3000 firms was exasperated with the un-structured processes related to operations and invoices in his finance team.

“Sometimes people in the organization would not even give any context on the invoice, nor even check if the goods had been delivered or not. They would just pass it on to us saying this is not our monkey to deal with, all yours.” Given that Sprinto processes an average of 150 invoices per month from 20 – 30 vendors, the ensuing chaos and probability of errors was inevitable.

To add fuel to the fire, many of the invoices would come in with urgent requests. The internal team members would then breathe down the neck of a finance team person with requests of processing this particular invoice as quickly as possible.

As per Naga, operations forms the base of the pyramid when it comes to handling finance in any organization and if this base is marred by chaos, then it becomes difficult for the team to function with full efficiency and deliver the required results. There was one finance person dealing only and only with invoice processing which was a wastage of time and resources.

Initial Automation Effort

This operational chaos was taking its toll on his small team and Naga decided to tackle this problem head on. He had lived in Bengaluru long enough for the entrepreneurial spirit to seep into his soul.

He decided to figure out small tools which he could build and manage internally himself. He relied on Google forms to automate some of the processes but the volume of invoices was so high that it was not really solving his problem.

He restarted his search for a fully automated solution; something which he had done on and off for the past 4 years. He had not been able to find anything substantial till he stumbled upon Pazy!

The Solution

When Naga saw the demo of the Pazy platform and how it automated the entire Accounts Payable process, he was relieved that his exhaustive search had finally reached a conclusion.The automation was such that it brought about structure to the whole process and the volume of invoices was no longer a concern. Pazy’s platform was built for scale.

“In the demo, it became very clear that these guys are very attuned to the needs of the customer.” Naga made this statement with reference to Pazy’s feature of an integration with the internal communication platform, Slack.

Sprinto’s entire team uses Slack for communications and this is where internal team members would drop in a note to the finance team that they have sent an invoice on email. The finance team person would then have to check the mails and again write back on Slack for further communication with respect to that invoice. If there were any errors or corrections, this cross platform communication would just add on to the chaos and timelines for processing.

Pazy eliminated this entire to and fro by ensuring that invoices could be uploaded on Slack itself, which would then automatically be synced with Pazy platform. The notification and communications would also be sent over Slack ensuring that all the communication was now under one roof.

Results – Structure

“Every finance function head is mostly looking to go from un-structured to structured processes via automation.” Pazy was able to bring about structure and eliminate the chaos that was plaguing the finance team at Sprinto. The automation helped his finance team save time and effort and gave them velocity to handle other tasks within the financial domain.

Earlier, the un-structured process of communication on Slack and invoice collection on e-mail would mean that each invoice approval would take anywhere between 2 to 3 working days. Pazy’s Slack integration got this average approval timeline to 1 to 2 hours flat.

OTHER BLOGS